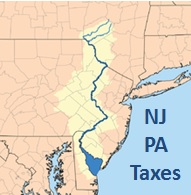

People who cross the Delaware River are now saved from major state income tax changes for 2017.

People who cross the Delaware River are now saved from major state income tax changes for 2017.

New Jersey Gov. Chris Christie in September announced plans to discontinue a long-standing tax reciprocity agreement between New Jersey and Pennsylvania but last week reversed course. The reciprocity agreement allows taxpayers to pay income tax in the state where they live, not where they work.

Christie said he would keep the tax agreement in place if the New Jersey Legislature found healthcare cost savings, which it did last week.

“By addressing a potential $250 million budget deficit from growing healthcare costs, we are now able to save an income tax reciprocity agreement with Pennsylvania that protects tens of thousands of hard working New Jerseyans from having to pay more income taxes,” Christie said in a statement.

READ MORE: Pennsylvania Expands and Extends Tax Credits for Businesses

Pennsylvania’s state income tax is a flat 3.07 percent. New Jersey has six marginal income tax rates for individuals, ranging from 1.4 percent for those earning $20,000 or less to 8.97 percent for income greater than $500,000. There also are seven rates for married couples filing joint returns.

Pennsylvania residents who work in New Jersey and earn more than $113,000 and file jointly would have had to pay more in state income taxes come 2017 if the agreement were called off, according to an analysis by The Philadelphia Inquirer. Conversely, New Jersey residents who work in Pennsylvania and earn less than $113,000 and file jointly would have paid less in state taxes, the Inquirer found.

READ MORE: New Jersey Taxpayers to Face Changes in Sales, Gas and Estate Taxes

The change also would have required Pennsylvania and New Jersey residents who work in the other state to file two state tax returns.

Christie’s recent reversal maintains the status quo for Pennsylvania and New Jersey residents who work in the other state. Please contact us with any questions you have about your state income taxes.