After being extended more than a dozen times by various pieces of legislation, the research and development (R&D) credit was finally made permanent by the Protecting Americans from Tax Hikes (PATH) Act of 2015.

After being extended more than a dozen times by various pieces of legislation, the research and development (R&D) credit was finally made permanent by the Protecting Americans from Tax Hikes (PATH) Act of 2015.

Now the Tax Cuts and Jobs Act (TCJA), goes one step farther. Not only does the law preserve the credit in all its glory, it generally enhances it in context of several other provisions.

Calculate the Credit

The R&D credit is intended to encourage spending on research activities by both established firms and start-ups. Generally, the credit equals the sum of:

- 20% of the excess of qualified research expenses for the year over a base amount,

- The university basic research credit (20% of the basic research payments), and

- 20% of the qualified energy research expenses undertaken by an energy research consortium.

The base amount is a fixed-base percentage of average annual receipts — net of returns and allowances — for the four years before the R&D credit is claimed. The fixed-base percentage can't exceed 16% and the base amount can't be less than 50% of the annual qualified research expenses.

Alternatively, a manufacturer or other business entity may claim a simplified R&D credit of 14% of the amount by which its qualified research expenses for the year exceed 50% of its average qualified research expenses for the preceding three tax years.

The credit is only available for qualified expenses, which must:

The credit is only available for qualified expenses, which must:

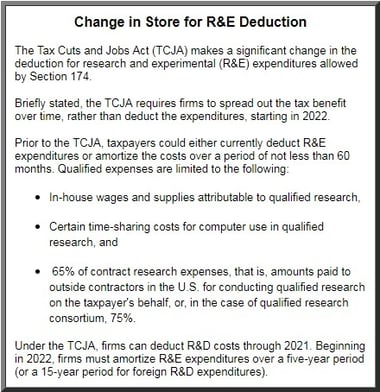

- Qualify as a "research and experimentation (R&E) expenditure" under Section 174 of the tax code (see box on right "Change in Store for R&E Deduction"), and

- Relate to research undertaken to discover information that is technological in nature and the application of which is intended to be useful in developing a new or improved business component.

In addition, substantially all the research activities must relate to a new or improved function, performance, reliability or quality.

While the R&D credit has always offered tax saving benefits for manufacturers, the TCJA opens even more opportunities to use the credit.

READ MORE: Learn the Many Tax Changes for Businesses and Individuals Under the Tax Cuts and Jobs Act

The R&D Tax Credit Following Tax Reform

Under the TCJA, the benefits of the R&D credit are enhanced when the following related provisions are taken into account:

Corporate AMT: Previously, the corporate alternative minimum tax (AMT) was a thorn in the side of firms utilizing the R&D credit. But the TCJA changes the landscape.

Corporate AMT: Previously, the corporate alternative minimum tax (AMT) was a thorn in the side of firms utilizing the R&D credit. But the TCJA changes the landscape.

Before the TCJA, a manufacturing firm generally could use the R&D credit only to offset regular tax liability, but not the corporate alternative minimum tax (AMT). Under a provision in the PATH Act, a limited exception was approved under which a business with $50 million or less in average gross receipts for the previous year could use the R&D credit to offset AMT liability.

That issue is largely moot, as the new law repeals the corporate AMT beginning in 2018. As a result, some larger firms will realize the tax benefits of the R&D credit. For individuals, though the AMT still exists, albeit at higher limits. Thus, if your R&D credit is from a pass-through entity, your ability to use it to offset the AMT may continue to be limited.

Expensing: The TCJA enhances both the Section 179 deduction and bonus depreciation. Under Sec. 179, the maximum expensing allowance is doubled from $500,000 to $1 million for property placed in service in 2018. The phase-out level increases from $2 million to $2.5 million. In addition, 50% bonus depreciation is doubled to 100% for a five-year period, beginning in 2018, before being gradually phased out over the following five years.

Thus, the new law encourages businesses to buy depreciable equipment for its research activities. In most cases, a firm will be able to expense the full cost in the year the equipment is placed in service.

Net operating losses (NOLs): Previously, a business could carry back an NOL for two years before carrying it forward for 20 years. Beginning in 2018, NOLs generally can't be carried back and may be carried forward indefinitely. However, they are limited to 80% of taxable income. Consequently, the R&D credit may be a valuable tool for firms with an NOL, because to the extent that they are not able to use an NOL to shelter income, the credit can be used to offset the tax that would otherwise be due.

Learn more about the R&D Tax Credit - and who can qualify - in this video:

Maximize the Credit

The R&D credit is still standing after the tax reform law and can be an even more effective tax shelter for manufacturers in the wake of the new law. Contact us for ways to maximize this credit and its related tax-savings opportunities.

© 2018