Do you have long-term capital gains or qualified dividends? If so, there's good news: After the Tax Cuts and Jobs Act, you might still qualify for the 0% federal income tax rate on these types of income.

Do you have long-term capital gains or qualified dividends? If so, there's good news: After the Tax Cuts and Jobs Act, you might still qualify for the 0% federal income tax rate on these types of income.

The rate is only available for those with relatively low income. But, if your income is too high to benefit, your children, grandchildren or other loved ones may still be eligible for the tax savings. Here are the details.

Same Rates, Different Brackets

The TCJA retains the 0%, 15% and 20% rates on long-term capital gains and qualified dividends. However, from 2018 through 2025, these rates are based on brackets that aren't tied to the ordinary income brackets.

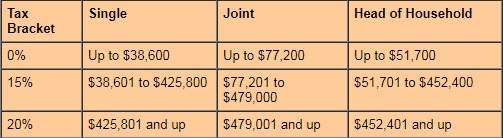

For 2018, the rate brackets for long-term capital gains and qualified dividends are:

After 2018, these brackets will be indexed for inflation. (See the right-hand box for a proposal to index the rate for inflation.) The TCJA also retains the 3.8% net investment income tax (NIIT) for higher-income individuals, which may apply to long-term capital gains and qualified dividends. So, for 2018 through 2025, the tax rates for higher-income people who recognize long-term capital gains and dividends and are affected by the NIIT are 18.8% (15% + 3.8% for the NIIT) or 23.8% (20% + 3.8% for the NIIT).

READ MORE: Individual Taxpayers Get Lower Rates, Other Big Changes Under New Tax Law

Who Could Benefit?

Here are some examples of taxpayers who are still eligible for the 0% rate bracket for long-term capital gains and qualified dividends:

- Ann and Bob are a married couple who file jointly for 2018. Their adjusted gross income (including long-term capital gains and dividends) is $101,200. After claiming the standard deduction of $24,000, the couple's taxable income is $77,200, which is the top of the 0% bracket for long-term capital gains and qualified dividends for joint filers.

- Carlyle uses head of household filing status for 2018. His adjusted gross income (including long-term capital gains and dividends) is $69,700. After claiming the standard deduction of $18,000, his taxable income is $51,700, which is the top of the 0% bracket for heads of households.

- Dana files as a single taxpayer for 2018. Her adjusted gross income (including long-term capital gains and dividends) is $50,600. After claiming the standard deduction of $12,000, her taxable income is $38,600, which is the top of the 0% bracket for long-term capital gains and qualified dividends for singles.

The adjusted gross income figures provided in these examples don't take into account any above-the-line write-offs, such as:

- Deductible retirement account contributions,

- Health savings account (HSA) contributions,

- Self-employed health insurance premiums, and

- Deductible alimony payments.

- To the extent that these hypothetical taxpayers have above-the-line deductions, their adjusted gross income could be that much higher without falling outside the 0% rate bracket for long-term gains and dividends.

Additionally, if an individual itemizes deductions — rather than taking the standard deduction — his or her adjusted gross income (including long-term capital gains and dividends) could be even higher than levels illustrated by these examples.

Tax Reform Provides Mixed Bag of Benefits to Families with Children

How Can High-Income People Help Loved Ones Cash In?

Is your income too high to benefit from the 0% rate on long-term capital gains and qualified dividends? You may have children, grandchildren or other loved ones who qualify for the break. If so, consider gifting them some appreciated stock or mutual fund shares. They can then sell the investments, and pay 0% tax on any resulting long-term capital gains. But there's a hitch: Gains will be considered "long-term" only if the ownership period of the donor and the gift recipient (combined) is at least a year and a day.

Giving away stocks that pay dividends can be another tax-smart idea. As long as the dividends fall within the gift recipient's 0% rate bracket, they'll be federal-income-tax-free.

For 2018, the annual gift tax exclusion for each individual is $15,000 per gift recipient. For example, by making joint gifts, a married couple could give investments worth up to $60,000 to their son and daughter-in-law (combined) without incurring gift tax or dipping into the unified federal gift and estate tax exemption. For 2018, this exemption is $11.18 million (effectively $22.36 million for married couples).

Contact Us

The 0% tax rate on long-term capital gains and qualified dividends applies only to long-term capital gains and dividends that accumulate in taxable investment accounts (like brokerage firm accounts) and long-term gains from investment assets (like real estate) that are held outside of tax-favored retirement accounts, including traditional IRAs and 401(k) accounts.

If you have questions or want more information about whether this potentially valuable tax break could work for you or members of your family, contact us for personalized assistance.

© 2018