The massive $2 trillion federal stimulus package, referred to as the CARES Act (Coronavirus Aide, Relief, and Economic Security Act), was signed by the President on Friday. Along with a slew of tax provisions, the Act includes a major new loan initiative for small businesses.

The massive $2 trillion federal stimulus package, referred to as the CARES Act (Coronavirus Aide, Relief, and Economic Security Act), was signed by the President on Friday. Along with a slew of tax provisions, the Act includes a major new loan initiative for small businesses.

Included in the CARES Act, the small business initiative – called the Keeping American Workers Paid and Employed Act – will provide $377 billion to help prevent workers from losing their jobs and small businesses from going under due to economic losses caused by the COVID-19 pandemic.

The Act includes a Paycheck Protection Program, where businesses will receive loans meant to help support payroll during the period February 15, 2020 through June 30, 2020 through 100 percent federally guaranteed loans if they maintain their payroll during this emergency.

If the employer maintains its payroll, then the portion of the loan used during the 8-week period beginning on the loan date for covered payroll costs, interest on mortgage obligations, rent, and utilities would be forgiven on a tax-free basis.

If the employer maintains its payroll, then the portion of the loan used during the 8-week period beginning on the loan date for covered payroll costs, interest on mortgage obligations, rent, and utilities would be forgiven on a tax-free basis.

The initiative is retroactive to February 15, 2020 to help bring workers who may have already been laid off back onto payrolls. Note that the amount of the loan that is forgiven will be reduced if the employer reduces its workforce (compared to other periods in 2019 or 2020) or reduces wages paid to employees making less than $100,000 annually by more than 25% during the 8-week covered period and does not rehire or increase the employee’s pay within an allotted time period.

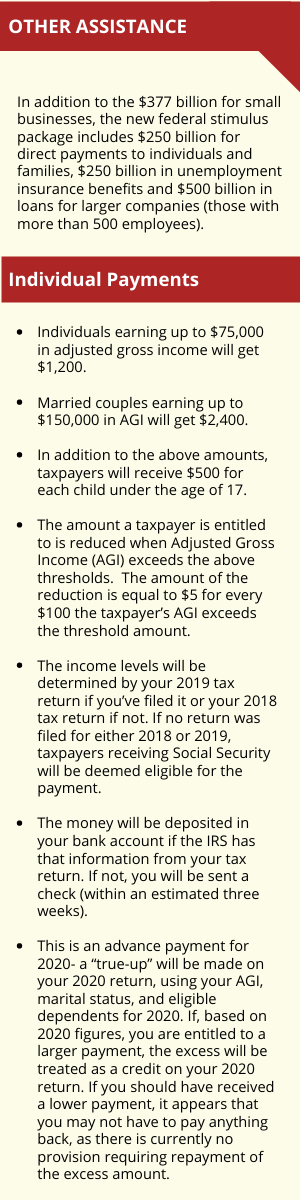

The stimulus package also includes measures to provide funding for individuals, unemployment insurance and larger companies. Learn more about those measures on the box on the right. Read on for more details on the small business provisions.

Small Business Paycheck Protection Program

- The bill provides $350 billion to support loans through a new Paycheck Protection Program for:

- Small employers with 500 employees or fewer, as well as those that meet the current Small Business Administration (SBA) size standards;

- Self-employed individuals and “gig economy” individuals; and

- Certain nonprofits, including 501(c)(3) organizations and 501(c)(19) veteran organizations, and tribal business concerns with under 500 employees.

- The size of the loans would equal 250 percent of an employer’s average monthly “payroll costs” plus any disaster loan taken out after January 31, 2020 that has been refinanced into a paycheck protection loan. The maximum loan amount would be $10 million.

- Covered payroll costs include salary, wages, and payment of cash tips (up to an annual rate of pay of $100,000 per individual); employee group health care benefits, including insurance premiums; retirement contributions; and covered leave.

- Covered payroll costs do NOT include payroll taxes, compensation to employees residing outside the U.S., or any Paid Sick Leave or Family Medical Leave for which a credit is allowed under the recently enacted Families First Coronavirus Relief Act.

- The cost of participation in the program would be reduced for both borrowers and lenders by providing fee waivers, providing for deferment of payments for at least 6 months and up to one year, and no prepayment penalties.

- Loans would be available immediately through more than 800 existing SBA-certified lenders, including banks, credit unions, and other financial institutions, and SBA would be required to streamline the process to bring additional lenders into the program.

- The Treasury Secretary would be authorized to expedite the addition of new lenders and make further enhancements to quickly expedite delivery of capital to small employers.

- The maximum loan amount for SBA Express loans would be increased from $350,000 to $1 million. Express loans provide borrowers with revolving lines of credit for working capital purposes.

READ MORE: New Employer Tax Credits, Employee Paid Leave Provisions Related to COVID-19

How to Apply

Start with your bank. Treasury Secretary Steven Mnuchin said just about every FDIC-insured bank will be authorized to approve and release the loans. Click here to see an updated list of banks ready to provide business loans under the CARES Act.

When Will the Money be Available

The federal government expects to have a process in place by the end of this week. The process is expected to be “very simple” Mnuchin said where the loans can be authorized and disbursed in the same day.

Required Financial Records

Underwriting standards are expected to be significantly more relaxed compared to typical SBA loans, officials say. The main underwriting standard for eligibility is expected to be proof of payroll costs. More details are expected to be forthcoming on required financial records in the next few days.

Stayed Tuned

With any new federal measure – especially one as sweeping as this – many of the details on how businesses can apply for the loans are still being worked out. We will keep you updated as they’re unveiled and also provide more information on other portions of the Act important for businesses.

Also for employers, the federal government earlier this month enacted two new refundable payroll tax credits to pay for Coronavirus-related leave to their employees. Learn details about those employer tax credits here.

Additional guidance on both measures is expected soon. Contact us to discuss financial relief measures that apply in your specific situation.