Federal tax reform through the Tax Cuts and Jobs Act provides many new tax benefits to McDonald’s Owner/Operators, including some major depreciation changes, most of which are beneficial, as we interpret the tax law changes.

Federal tax reform through the Tax Cuts and Jobs Act provides many new tax benefits to McDonald’s Owner/Operators, including some major depreciation changes, most of which are beneficial, as we interpret the tax law changes.

Under the new act, Bonus Depreciation is increased from 50% to 100% for qualifying property. The new provision also expands Bonus Depreciation to include both new and used qualifying assets, assuming they are acquired under an arms-length transaction. Thus, in a sales between operators transaction, the equipment allocation is now eligible for Bonus Depreciation.

The new bonus provision is made retroactive back to assets placed in service after September 27, 2017. However, during the time period of September 27 through December 31, 2017, you have the option of electing 100% or 50% Bonus Depreciation, whichever may be best for your situation. The 100% Bonus Depreciation is available through the end of 2022 at which time the bonus depreciation will decline by 20% annually until it is phased out in 2027.

The act also expands the annual 179 expensing limits. The Section 179 limits for 2017 were $500,000 annually on purchases of $2 million or less. For 2018, the annual Section 179 limits increase to $1 million with a maximum purchase limit of $2.5 million. Thus, the Section 179 expensing limit doubles for 2018.

In regards to the amount of 179 available for purchases of SUVs, the $25,000 limit is still intact. However, all of these limits will be indexed annually for inflation.

In addition to the increased 179 limits, the act also expands the definition of additional items that will now be eligible for Section 179. This will include Qualified Improvement Property or QIP, as well as certain improvements to the building that includes roofs, HVAC units, fire protection and security systems.

READ MORE: Business Equipment Tax Breaks Enhanced for McDonald’s Franchisees

Take the Good News with the Bad

Qualified Improvement Property is a new term that McDonald’s Owner/Operators will need to be aware of. The term Qualified Leasehold Improvement is replaced with the new QIP and the term Qualified Restaurant Property is permanently removed. QIP will be eligible for 15-year depreciation and be eligible for both 179 and Bonus.

Qualified Improvement Property is a new term that McDonald’s Owner/Operators will need to be aware of. The term Qualified Leasehold Improvement is replaced with the new QIP and the term Qualified Restaurant Property is permanently removed. QIP will be eligible for 15-year depreciation and be eligible for both 179 and Bonus.

Qualified Improvement Property is defined as an improvement to the interior portion of a non-residential building. These improvements must be made after the building is placed in service and does not enlarge or change the internal structure. This means that rebuilds, relocations and new store builds will not qualify as Qualified Improvement Property. These changes take effect for any assets placed in service starting January 1, 2018.

Qualifying projects include restroom remodels, tile and lobby work and certain upgrades necessary to install the EOTF equipment.

Last Year Versus This Year

As we know, many McDonald’s franchisees are undergoing a lot of reinvestments, with many of them substantial. So, let’s see how this change will affect your ability to depreciate these larger reinvestments to experience the biggest tax savings.

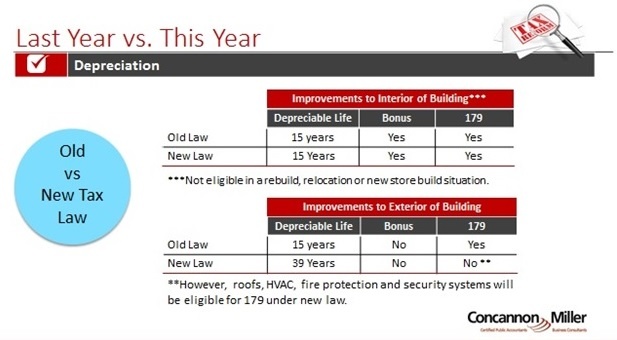

Let’s first look at improvements made to the interior portion of the restaurants. These were previously classified as QLI and are now QIP. As you can see, there really is no change in your ability to depreciate these improvements quickly if needed as they are eligible for both 179 and Bonus Depreciation, as we interpret the tax law changes.

However, these items are not eligible to be treated as QIP in a rebuild, relocation and new store build situation. In these situations, these items would not be eligible for 15-year depreciation, but instead would be depreciated over 39 years with no ability for 179 or Bonus Depreciation.

More Depreciation Changes Examples - Click Here

Now let’s look at the changes to improvements to the exterior of the building. This is where there are significant differences in comparing the old depreciation rules versus the new depreciation rules. These improvements, under the new law, will no longer be eligible for 15-year depreciable life or 179 expensing. Instead, these items will be depreciated over 39 years.

Because of this change, it may be quite beneficial to obtain a cost segregation study on these projects. This could allow you to move more of the costs into shorter asset lives and provide some flexibility with available depreciation deductions.

The one caveat here is that there are certain exterior improvements that will be eligible for 179 expensing even though they are 39-year assets. As mentioned, these items consist of roofs, HVAC units, fire protection and security systems.

READ MORE: Tax Reform & McDonald’s Franchisees: The Benefits

Farewell to Section 1031

Effective for January 1, 2018, Section 1031 or Like-Kind Exchanges are no longer available with the sale of a restaurant. Thus, if someone’s plan was to sell one of their existing restaurants in order to purchase three new restaurants, they would no longer be able to defer paying the tax on the gain from the sale of their existing restaurant. Instead, they would need to pay tax on the gain, which would provide less net proceeds for investing in the new restaurants.

However, you would be able to depreciate/amortize the purchase price of the new restaurants. And, with 100% Bonus Depreciation now available on the equipment allocation of the purchase price, you may be able to limit the tax liability you will incur.

Luxury Auto Depreciation

The last item related to depreciation that’s relevant to some McDonald’s franchisees is luxury auto depreciation. Luxury autos are generally passenger vehicles under 6,000 pounds gross vehicle weight. The act substantially increased the annual depreciation amounts that are available.

As you can see from the chart, the annual limits have almost tripled.

|

|

New Law |

Old Law |

|

1st year |

$10,000 |

$3,160 |

|

2nd Year |

$16,000 |

$5,100 |

|

3rd Year |

$ 9,600 |

$2,440 |

|

4th & Later Years |

$ 5,760 |

$1,500 |

We’ve developed three examples of how the depreciation changes might affect McDonald’s Owner/Operators. The examples cover lobby remodels and EOTF, a full MRP and a rebuild/relocation/new restaurant build. Click here to view the examples.

With so many changes to the depreciation rules, planning – although always needed – will be even more critical for all of the reinvestments being completed in the restaurants, including a personalized assessment for your particular situation. Please contact us for assistance on how to maximize depreciation tax savings under the new tax law.