Financial health is critically important to your success as a McDonald’s Owner/Operator. To help you measure your financial health, we’re doing a series of articles on the McDonald’s financial standard ratios, what they entail and how to improve them.

Financial health is critically important to your success as a McDonald’s Owner/Operator. To help you measure your financial health, we’re doing a series of articles on the McDonald’s financial standard ratios, what they entail and how to improve them.

If you missed them, check our prior articles Understanding and Managing Financial Ratios for McDonald’s Franchisees and An Important Metric for Franchisees: Trailing Twelve-Month Liability Turnover.

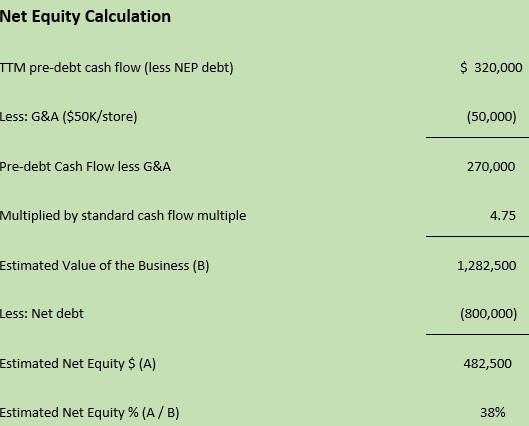

The next financial viability measure we’ll discuss is the estimated net equity percentage. It represents the estimated percentage you own of your business. It’s the hypothetical amount of money that would be remaining after your business is liquidated before paying income taxes.

McDonald’s minimum net equity percentage to be eligible for growth and rewrite is 25%. The estimated net equity is calculated by reducing the estimated restaurant value by the business's net debt. Dividing the estimated net equity by the estimated restaurant value will provide the estimated net equity percentage.

Estimated Net Equity Percentage Calculation

The following is an example of the calculation of the estimated net equity percentage. And we’ll define the specific terms as we discuss the calculation.

TTM PDCF: We should all be familiar with this number. It is reported monthly on your WebFFS TTM Operating P&L. It’s the amount of cash flow available after paying routine operating expenses before paying G&A, debt service, and the Owner/Operator.

Less NEP Debt: NEP stands for the New Economic Package. Actually it’s an Old Economic Package that originated back around 2000-2001. As a result, most of the loans used in this program have matured. Therefore we won’t discuss this concept in great detail.

G&A: This is General and Administrative Expenses. In this calculation of estimated net equity, the G&A component is $50,000 per restaurant no matter what your actual G&A cost. Using $50,000 per restaurant provides consistency across systems. The TTM PDCF is reduced by the G&A amount since it’s an additional cost of doing business.

Standard CF Multiple: A multiplier used by McDonald’s to estimate the restaurant value. This multiplier doesn’t change based on location of restaurants (some locations may be more desirable to Owner/Operators than others) or restaurant reinvestment needs or anything else.

It’s a multiplier McDonald’s Corp. determined so a quick calculation on any restaurant can be done without the estimated net equity value being overstated. If by using this formula, the equity percentage is too close to the 25% minimum requirement, McDonald’s will value the restaurant using the discounted cash flow valuation approach which provides a more reasonable value of the restaurant.

In the example, the PDCF less G&A is multiplied by the CF Multiple to obtain the Estimated Value of the Business. The Estimated Value of Business (letter B in the example) is the value of the restaurant equipment and franchise only. This Estimated Value of Business is then reduced by Net Debt to arrive at the Estimated Net Equity.

Net Debt: Net Debt is simply your Total Liabilities (Current & Long-Term) - not including NEP loans less your Current Assets.

If your Current Assets exceeded your Total Liabilities, your Net Debt would be positive and increase the Estimated Value of the Business to arrive at Estimated Net Equity. The Estimated Net Equity is then divided by the 100% Value of the Business to determine the Estimated Net Equity percentage.

How Changes in Your Business Impact Net Equity

Activities with a positive impact:

- Improved cash flows

- Decreased liabilities

- Increase current assets

Activities with a negative impact:

- Decrease cash flows

- Increase liabilities

- Decrease current assets

How to Improve Net Equity Ratio

- Increase restaurant cash flows

- Pay down debt

- Make capital contributions to the business

- Reduce G&A expenses

- Reduce draws

The last four on this list help improve not just your estimated net equity percentage but all three of the McDonald’s financial statement ratios.

Concannon Miller’s clients receive full FVA reports every month so that they are always up to date on their financial viability standing. Are you looking to be better informed? Contact us to find out more.