Did you feel like your taxes were minimized last year? If not, it’s possible you may have missed out on some opportunities.

Did you feel like your taxes were minimized last year? If not, it’s possible you may have missed out on some opportunities.

Federal tax reform through the Tax Cuts and Jobs Act provided some of the best tax benefits to businesses in more than 50 years. The corporate tax rate was slashed from the graduated maximum of 35% to a flat 21%.

There also was big news for smaller businesses – the new Qualified Business Income Deduction offers possibly the greatest tax benefit to pass-through businesses in more than 60 years. QBI allows qualified small business owners to simply not pay income taxes on 20% of their qualified income in tax years 2018 through 2025.

While every tax situation is different and savings are not guaranteed, most of the businesses we work with had a good 2018 tax year.

Did you? If not, download our free Top 6 Tax Reform Opportunities for Business guide. Learn about the latest tax strategies for businesses to see if you could benefit.

Did you? If not, download our free Top 6 Tax Reform Opportunities for Business guide. Learn about the latest tax strategies for businesses to see if you could benefit.

Download the guide now, or check out one of the six strategies below:

Tax Entity Structure

Are you a single member LLC or sole proprietorship? If so, you may want to think about making a subchapter S election to take advantage of the new Qualified Business Income Deduction.

Here’s why: Single member LLCs and sole proprietorships cannot pay their owner a salary. If you convert to an S Corp, here’s an example of how you can use QBI to save more on taxes:

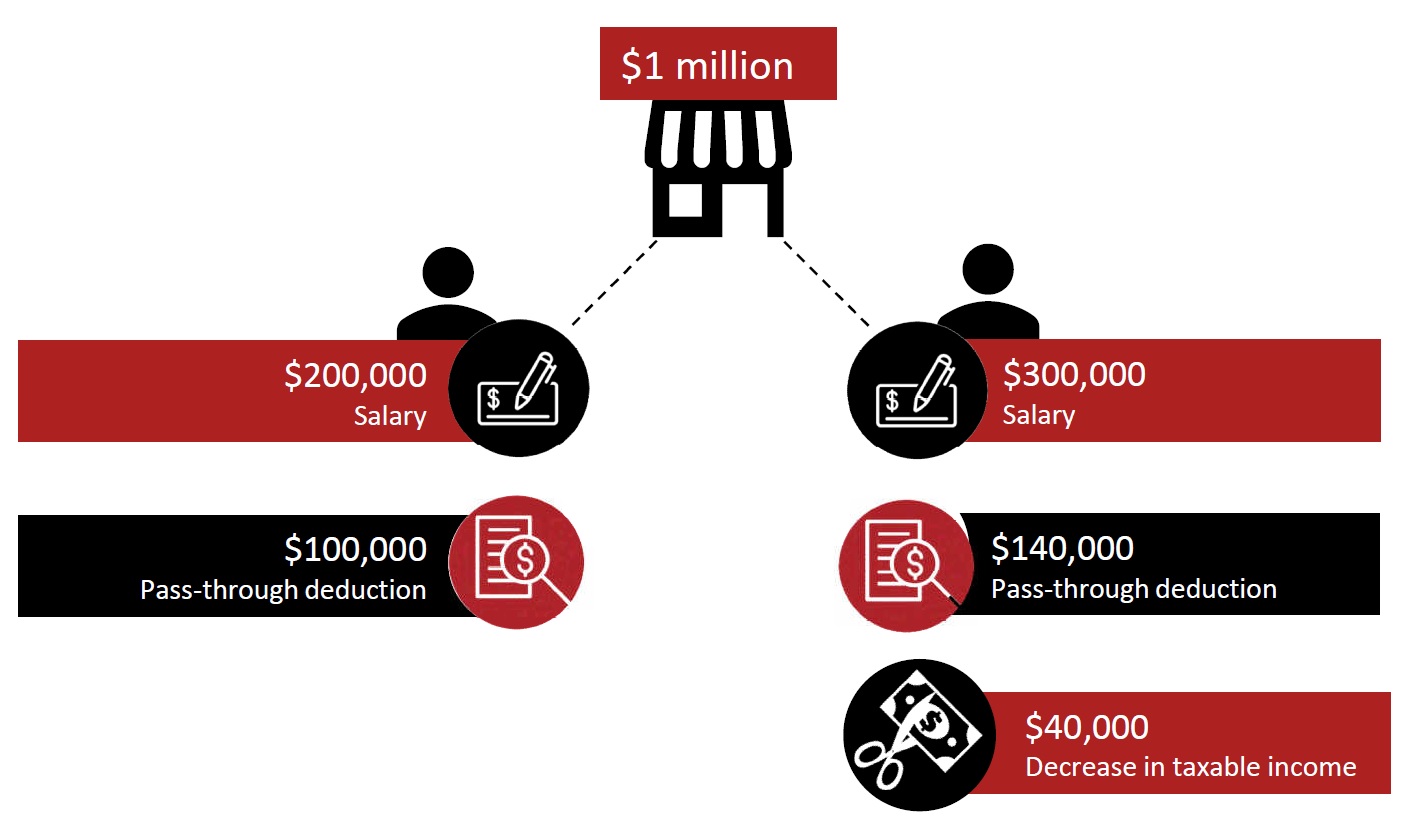

An S Corp earns $1 million and pays a salary of $200,000 to its sole owner and sole employee. The W-2 wage limitation would limit the pass-through deduction to $100,000, or 50% of the wages.

However, if the owner increased her wages to $300,000 and thus decreased the corporate earnings to $700,000, the pass-through deduction, still subject to the wage limitation, would increase to $140,000. As a result, the owner would decrease her taxable income by $40,000 at the price of a minor increase in payroll taxes.

For one of our business clients, we switched his company from being taxed as a sole proprietor to being taxed as an S corporation. The change saved him $140,000 in taxes this year and will save him $75,000 annually moving forward.

Want to learn more? Click here to download our complete Top 6 Tax Reform Opportunities for Businesses guide or contact us here.