The IRS has issued proposed regulations that provide guidance under new provisions added by the Tax Cuts and Jobs Act (TCJA) related to Qualified Opportunity Funds (QOFs). Specifically, the guidance addresses the gains that may be deferred as a result of a taxpayer's investment in a QOF, as well as special rules for an investment in a QOF held by a taxpayer for at least 10 years.

Looking to Invest in Opportunity Zones? There’s New Guidance for This Tax Benefit

Posted by Concannon Miller on Tue, May 14, 2019

Topics: Construction & Real Estate Development, 2017 Federal Tax Reform

New Real Estate Investment Tax Benefit: FAQs on Opportunity Zones

Posted by IRS on Thu, Apr 25, 2019

Tax Reform through the Tax Cuts and Jobs Act provided a new tool for promoting and incentivizing long-term investment in low-income communities.

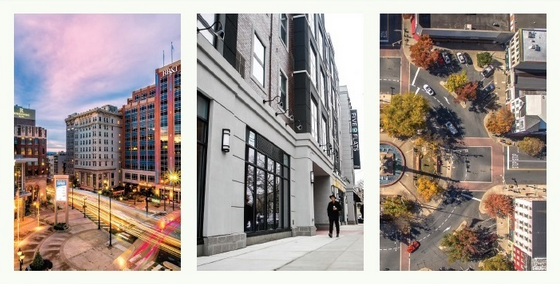

Opportunity Zones are economically-distressed communities where new investments, under certain conditions, may be eligible for preferential tax treatment.

Learn more about them in this comprehensive Opportunity Zones FAQ from the IRS. Also, see the Lehigh Valley’s Opportunity Zones here.

Topics: Construction & Real Estate Development, 2017 Federal Tax Reform

Seize the Opportunity (Zone), But Keep Your Head on Straight

Posted by Stuart Eisenberg and Marla Miller on Thu, Mar 28, 2019

The IRS defines an opportunity zone as an “economically distressed community where new investments may be eligible for preferential tax treatment.” The Treasury has certified nearly 9,000 of these districts across all U.S. states and its territories, including the entire island of Puerto Rico. An opportunity zone designation has the potential to trigger a rush of investment activity and is intended to help revitalize neglected areas.

A qualified opportunity zone fund is an investment vehicle that must invest at least 90 percent of its assets in businesses that operate in a qualified opportunity zone, either by acquiring stock or a partnership interest. The fund can also make direct investments in properties and real estate located within a qualified opportunity zone. REITs and other operators are forming opportunity zone funds to access the capital expected to be generated by this program to acquire and develop properties.

Topics: Construction & Real Estate Development, 2017 Federal Tax Reform

Reasons for Construction Companies to Certify Financial Statements

Posted by Concannon Miller on Thu, Feb 28, 2019

Throughout the year, construction companies and real estate developers need to be able to provide verified financial results to others.

This may be your CPA, a lender or investor, a potential purchaser of your business — should you decide to sell — or another interested party. Not to mention that you, as the construction company owner should know your books are being done with accuracy and completeness.

For all of these reasons, you should consider having your CPA prepare certified financial statements for your business, rather than always relying on internally generated reports.

Tax Reform & More: 5 Construction & Real Estate Predictions for 2019

Posted by Concannon Miller on Tue, Feb 5, 2019

Marked by turbulent trade conditions, a shifting retail landscape, continued fallout over tax reform and the accelerated growth of coworking companies, 2018 has been an eventful year for the real estate and construction industries.

As we enter 2019, a variety of forces are at play. The IRS will continue to release additional guidance on provisions introduced via tax reform, the future of U.S. trade policy is uncertain and interest rates will likely rise again.

As the new year unfolds, we’ve outlined our top five predictions for 2019.

Construction Companies: How to Avoid IRS Problems from Using Independent Contractors

Posted by Concannon Miller on Thu, Dec 13, 2018

Chances are, your construction business hires subcontractors, rather than employees, to perform some of the work. These arrangements obviously save your company a lot of time, money and headaches. Take a look at some of the recordkeeping and financial differences:

Construction Accounting: How to Determine the Best Method

Posted by Concannon Miller on Tue, Nov 13, 2018

As you may know, contractors have multiple accounting methods to choose from. But some are off-limits to certain contractors. As your construction company endures the ups and downs of a bumpy industry, it's worth your while to review your options.

Multiple Tax Entities: The Pros and Cons for Construction

Posted by Concannon Miller on Thu, Oct 18, 2018

It might be advantageous from a tax standpoint to run a business through multiple entities. For example, a construction company might form a separate company to own and lease its trucks and equipment back to its related entities. Or a corporation might transfer appreciated property to an affiliated corporation in order to limit risk in case it is sued.

However, the IRS may look twice at an operation if it includes multiple business entities -- especially if recordkeeping and filing requirements aren't handled properly. One construction firm in Georgia discovered that lesson the hard way when it took deductions that actually belonged to one of its corporate affiliates.

Thinking of Buying Another Construction Firm? What to Consider

Posted by Concannon Miller on Thu, Sep 20, 2018

Buying another construction firm can be an attractive way to grow your company's revenue base. A merger or an acquisition can allow you to:

- Add a new subcontracting specialty,

- Acquire an experienced labor force to reach new markets, and

- Deepen your penetration into the market your firm already serves.

Topics: Business Valuation, Construction & Real Estate Development

Tax Reform Expands Simpler Accounting Method for More Small Businesses

Posted by Concannon Miller on Thu, Sep 6, 2018

Thanks to changes included in the Tax Cuts and Jobs Act, many more businesses can now use the simpler and more-flexible cash method of accounting for federal income tax purposes. The new law also includes some other tax accounting changes that are good news for small businesses. Like many TCJA changes that apply to businesses, these provisions are permanent. Here's what you need to know.

Topics: Construction & Real Estate Development, 2017 Federal Tax Reform