Owning and operating a McDonald’s franchise business is complicated, and even more challenging if you’re looking for growth and rewrite.

Owning and operating a McDonald’s franchise business is complicated, and even more challenging if you’re looking for growth and rewrite.

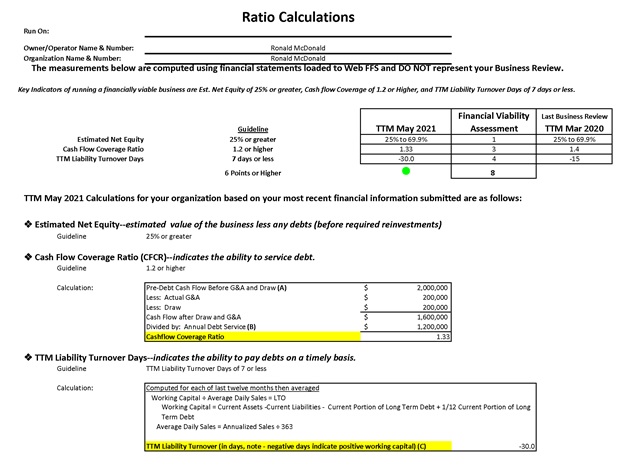

A key to those opportunities is maintaining your financial ratios. McDonald’s Corp. established these ratios to ensure financial stability. A solid understanding of the ratios that make up financial viability, how they are calculated, and why they are important will enable you to make any necessary adjustments to improve your financial viability and often your bottom line.

There are three McDonald’s financial standard measures that are required for an Owner/Operator to be viewed as a financially viable organization. Failure to meet one of these measures during your business review will result in a financial standards rating of “does not meet.”

One of the most important financial standard measures is financial viability, which we will give an overview of in this article and go into depth on its components in future articles.

The suggested guidelines from McDonald’s are:

- Cash flow coverage ratio greater than or equal to 1.20

- Trailing Twelve Month Liability Turnover of 7 days or less

- Estimated Net Equity greater than or equal to 25%

McDonald’s assigns a point value for each one of these measurements and when aggregated, meeting these suggested benchmarks will yield a score of 6, which meets the McDonald’s financial viability standard.

Evaluating Financial Viability

Here is the total point system used by McDonald’s applied to the individual viability measurement and subsequently aggregated to assess overall financial viability.

A minimum score for each of the three measures yields a total score of 6, which meets financial viability. However, stronger scores will help to ensure a healthier financial position.

Breaking it down to the individual components:

- The Cash Flow Coverage Ratio has a point value of -1, 1, 2, 3, or 4

- The Trailing Twelve-Month Liability Turnover has a point value of -2, 0, 2, 3, or 4 ; and

- The Net Equity has a point value of -2, 1, or 2

The maximum score you can obtain is 10. A score of 9 and above is the gold standard of financial health.

Why the Ratios are Important

Why are these ratios important? The best answer is that this is your business, and these ratios help you assess the financial strength of your business, both from a P&L and balance sheet perspective, and they help you analyze how any future financial adjustments or business opportunities will affect your financial stability.

These ratios are included as part of your loan covenants with your lenders and are used by McDonald’s as part of the financial standard assessment during your business review process to determine eligibility for growth and rewrite and eligibility for participation in certain programs and incentives.

What do the ratios tell us? Here are three important items:

- They provide banks and other interested parties with insight to operator’s financial position in terms of meeting short term needs (upcoming bills) and long-term (future obligations such as taxes, rent escalations, etc.)

- They provide comfort level on the amount of equity you have in the undesirable event the business starts to take a downturn and assets need to be sold to satisfy creditors.

- They help assess your ability to take on new risks (i.e., new store, major re-investment, etc.)

READ MORE: Two Extended Tax Benefits Eligible McDonald’s Franchisees Should Consider

Financial Viability Assessment (FVA)

As mentioned earlier, McDonald’s assigns a point value to each of the financial viability measures.

Here is a snap-shot of what is available on WebFFS each month after submitting your financial statements. This is listed under Reporting – View Key Reports – Other Reports – Ratios. You select the end month for your report and Generate the Report.

As mentioned before, the maximum points an operator can achieve is 10 points. The TTM Liability Turnover Ratio has a maximum of 4 points, the estimated net equity has a maximum of 2 points and the cash flow coverage ratio has a maximum of 4 points.

If the points add up to 6 or more, the organization “meets” the financial viability measure. At 5 points, the organization “does not meet” the financial viability measure.

Concannon Miller’s clients receive full FVA reports every month so that they are always up to date on their financial viability standing. Are you looking to be better informed? Contact us to find out more.