Financial health is critically important to your success as a McDonald’s Owner. To help you measure your financial health, we’re doing a series of articles on the McDonald’s financial standard ratios, what they entail and how to improve them.

Financial health is critically important to your success as a McDonald’s Owner. To help you measure your financial health, we’re doing a series of articles on the McDonald’s financial standard ratios, what they entail and how to improve them.

If you missed them, check our prior articles Your Next McDonald’s Ratio: Estimated Net Equity Percentage, Understanding and Managing Financial Ratios for McDonald’s Franchisees, and An Important Metric for Franchisees: Trailing Twelve-Month Liability Turnover.

Cash Flow Coverage Ratio seems to be the most popular McDonald’s financial viability ratio and it may well be the most important. This ratio is an indicator of an organization’s ability to pay its creditors. It indicates whether or not the organization generates enough funds to pay all of its business expenses (including compensating the owner), service the debt, and provide sufficient reserves in down times.

The McDonald’s standard is to have a CFCR of 1.2 or better. A CFCR of 1.2 means you have enough cash flow to cover all your operating expenses, debt service, and have an amount equal to 20% of your debt service available for reserves.

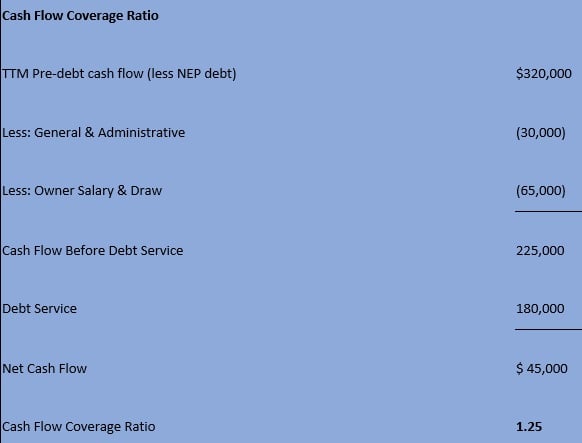

Trailing 12-month pre-debt cash flow is the starting point for calculating the Cash Flow Coverage Ratio. Pre-debt cash flow is reduced by G&A expenses (including owner’s salary) and draws to arrive at the organization’s cash flow before debt service. And finally, the cash flow before debt service is divided by the annual debt service to obtain CFCR.

Here is an example of the cash flow coverage ratio calculation:

How Changes in Your Business Impact the Cash Flow Coverage Ratio

Changes that produce positive impacts:

- Decreased borrowing

- Maturing debt

- Reduced G&A

- Reduced draw

- Increased sales

- Increased profitability

Changes that produce negative impacts:

- Increased borrowing

- Increased G&A

- Increased draw

- Decreased sales

- Decreased profitability

How to Increase Cash Flow Coverage Ratio

To improve your cash flow coverage ratio, consider the four components used in calculating the ratio. It is impacted by: operating results (changes that you can make in the restaurant), G&A expenses (changes that you can make in your back office), draw (changes that you can make at home) and debt service.

Impact of Debt Service and Future Planning

Most Owners know their loan terms or at least when the debt matures and that is critical for planning and projecting your cash flow coverage ratio trend.

When additional restaurants are acquired or substantial reinvestments are financed, your monthly debt service will increase immediately but the full effect of the cash flows from the acquired restaurants or the improvements may not be realized immediately. Be mindful that all the ratios consider a trailing twelve-month measurement period, so it is important to project the monthly CFCR after a significant investment to ensure compliance after the transition period.

Also, the amount of these major investments financed and the amount of any down payment can significantly affect the ratio. Application of any down payment, whether to the new debt or existing debt is a major consideration.

Draw Implications on CFCR

One of the outflows for calculating the CFCR is an Owner’s draw. This CFCR component is typically the most unpredictable factor. Draw includes amounts needed for your basic living expenses, discretionary spending, taxes, retirement funding, children’s education, and personal savings.

In some business plans, a base salary is used to cover basic needs (including living expenses) and then a draw is used for discretionary spending. Under this scenario, when the business has a good year, more can be used for discretionary spending. The opposite is true in a down year, however all basic needs will be covered by the base salary.

In most instances, a draw is taken from the business to cover the taxes owed on the business income since most of the businesses are structured as pass-through entities. Income is being taxed at the individual level. As a result, this projected tax drop-off must be budgeted when projecting the CFCR for the business.

When analyzing or projecting your CFCR, each of its four components need to and should be addressed. Sometimes the answer to improving the CFCR doesn’t lie in a significant change to one component but rather minor changes to multiple components.

Concannon Miller’s clients receive full FVA reports every month so that they are always up to date on their financial viability standing. Are you looking to be better informed? Contact us to find out more.