New Jersey enacted major tax changes earlier this month, including a sales tax reduction, gas tax increase and plans to phase out state estate taxes by 2018.

New Jersey enacted major tax changes earlier this month, including a sales tax reduction, gas tax increase and plans to phase out state estate taxes by 2018.

The state Legislature also increased exclusions for pension and retirement plan income and increased earned income tax credit.

Get details on all the changes below, including the planned end to New Jersey’s income tax reciprocity agreement with Pennsylvania, which will affect both New Jersey and Pennsylvania residents who cross the Delaware River for work.

Sales and use tax reductions: Beginning in January, the sales and use tax rates are going from 7% to 6.875%, then to 6.625% in 2018.

Hotel occupancy fees: Also starting in January, the hotel and motel occupancy fees cannot exceed 13.875%, down from 14%. In 2018, they’ll drop to a maximum of 13.625%.

READ MORE: Attention Pennsylvania and New Jersey Commuters: State Tax Changes are Likely

Estate tax changes: There is now a two-year phase out of the estate tax. Starting in January, the current exclusion goes from $675,000 to $2 million. The estate tax is then totally eliminated as of Jan. 1, 2018. It also eliminates the estate taxes for New Jersey property owners that are nonresident decedents.

Gas tax increase: The state Legislature approved a 23 cent-per-gallon increase in their highway fuels tax to pay for transportation work throughout the state. It’s scheduled to go into effect Nov. 1.

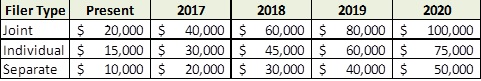

Pension and retirement income tax exclusions: The cap on the gross income tax pension and retirement exclusion increases will be phased in over a four-year period. Below is a chart with the phase in of the increase for each type of filer.

Earned income tax credit: The earned income tax credit increased from 30% to 35% of the federal benefit amount. This is retroactive to Jan. 1, 2016.

Veterans’ exemption: Veterans are being granted a $3,000 personal exemption from taxation.

Income tax reciprocity agreement between New Jersey and Pennsylvania: Gov. Chris Christie has given notice that New Jersey’s reciprocity income tax agreement with Pennsylvania – which has been in effect for nearly 40 years – will end Dec. 31. Currently, if a Pennsylvania resident works in New Jersey, they do not have to pay New Jersey income taxes, but rather are able to pay Pennsylvania income taxes, essentially paying and filing state income taxes where they live rather than where they work. It’s the same case for New Jersey residents who work in Pennsylvania.

Income tax reciprocity agreement between New Jersey and Pennsylvania: Gov. Chris Christie has given notice that New Jersey’s reciprocity income tax agreement with Pennsylvania – which has been in effect for nearly 40 years – will end Dec. 31. Currently, if a Pennsylvania resident works in New Jersey, they do not have to pay New Jersey income taxes, but rather are able to pay Pennsylvania income taxes, essentially paying and filing state income taxes where they live rather than where they work. It’s the same case for New Jersey residents who work in Pennsylvania.

With Pennsylvania’s tax rates at 3.07% and New Jersey’s highest rate at 8.97%, this could greatly increase a Pennsylvania resident’s tax bill, because Pennsylvania would limit the credit for taxes paid to New Jersey at 3.07%. For top wage earnings, they would be paying 5.9% more in state income taxes.

Also, for both Pennsylvania residents that work in New Jersey and vice versa, they would be obligated to file both Pennsylvania and New Jersey income tax returns. This will be a big change for New Jersey residents who work in Philadelphia as they will not be able to take a tax credit for the Philadelphia wage tax, which is presently at 3.4741% for non-residents.

This has not come without much backlash from large companies that recently relocated from Pennsylvania to New Jersey. Many of these companies that have relocated just over the border from Philadelphia attract a lot of Pennsylvania employees. The Pennsylvania commuters will now be straddled with a much higher state income tax bill.

For guidance on how these changes might affect you, please contact us.